From finance professor Jialan Wang comes this really interesting analysis: Benford’s Law and the Decreasing Reliability of Accounting Data for US Firms.

Basically, by looking at the distribution of leading numerals in sets of numbers, you can often spot cases of people “cooking the books”. People engaged in fraudulent accounting practices tend to make up randomish-looking numbers. But real measurements of phenomena that span orders of magnitude tend to follow a distinctly non-randomish pattern called Benford’s Law, with leading 1’s being more common than 2’s, which are more common than 3’s, and so on.

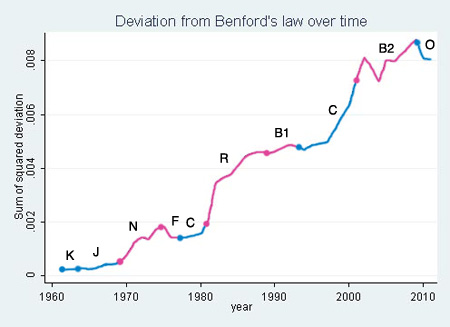

What Prof. Wang did was to look at historical accounting data for big US companies and analyze the data’s conformity with Benford’s Law. The whole blog post is really interesting, but one of the most interesting things she found was this: Deviation from Benford’s Law, though initially small, has grown dramatically over the last 40 years, reaching record levels in 2009:

Her conclusion:

While these time series don’t prove anything decisively, deviations from Benford’s law are compellingly correlated with known financial crises, bubbles, and fraud waves. And overall, the picture looks grim. Accounting data seem to be less and less related to the natural data-generating process that governs everything from rivers to molecules to cities. Since these data form the basis of most of our research in finance, Benford’s law casts serious doubt on the reliability of our results. And it’s just one more reason for investors to beware.

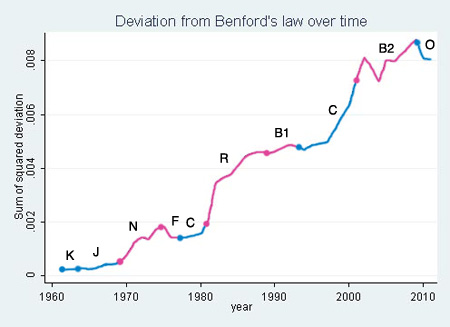

Update: You ask, I deliver. Here’s Wang’s chart, annotated to indicate which party occupied the White House during the years in question:

Perhaps unsurprisingly, Reagan, with his hostility to government regulation, oversaw dramatic increases in deviation from Benford. The famously corrupt Nixon did as well. But so did Clinton.

The Kennedy, Johnson, Carter, and elder-Bush administrations were all pretty undramatic, with flat or slightly upward trends in Benford deviation.

Bush the younger oversaw a dramatic up, down, and up again pattern of deviation, ending significantly higher than he started.

Obama, at least so far, looks a lot like Gerald Ford in terms of having presided over a rapid drop in Benford deviation (albeit one dwarfed by the overall upward trend).

Ultimately, I think these numbers probably have more to do with the larger business climate than with which party holds the White House. Boom times and bubbles tend to produce greater deviations, as get-rich-quick cowboys make their own rules and ride the wave upward. Times of greater regulatory concern (like the post-Watergate Ford administration, the 2002 enactment of Sarbanes-Oxley under George W. Bush, and Obama’s time since the 2008 financial meltdown) see the deviations come back down a bit.

But the overall trend for the last 50 years has been up, pretty much regardless of which party was in power.